Our US-based client was willing to revamp their claim processing system as they were dependent mostly on manual verification and documentation. Their mission was to build an advanced AI-powered claims assistance platform to automate assessment, validation, and fraud detection. With this implementation, our client noticed a reduction in their turnaround times and better customer satisfaction.

The client briefed us with major modifications to their existing insurance claim processing systems. They wanted to reduce manual efforts, make operational efficiency better, and enable faster claim settlements. They were looking for an AI-powered solution that can upgrade accuracy levels, meet regulatory compliance, and offer a seamless customer experience.

The client was facing challenge with processing large volumes of claim forms and documents led to inefficiencies and inaccuracies.

Another major challenge our client shared with us is lack of automated validation made it difficult to detect anomalies or false claims.

What was hindering their decision-making process was a cross-departmental coordination, which they highlighted as their key fixes under business objectives.

Customers faced long waiting periods for claim status updates, affecting satisfaction and trust

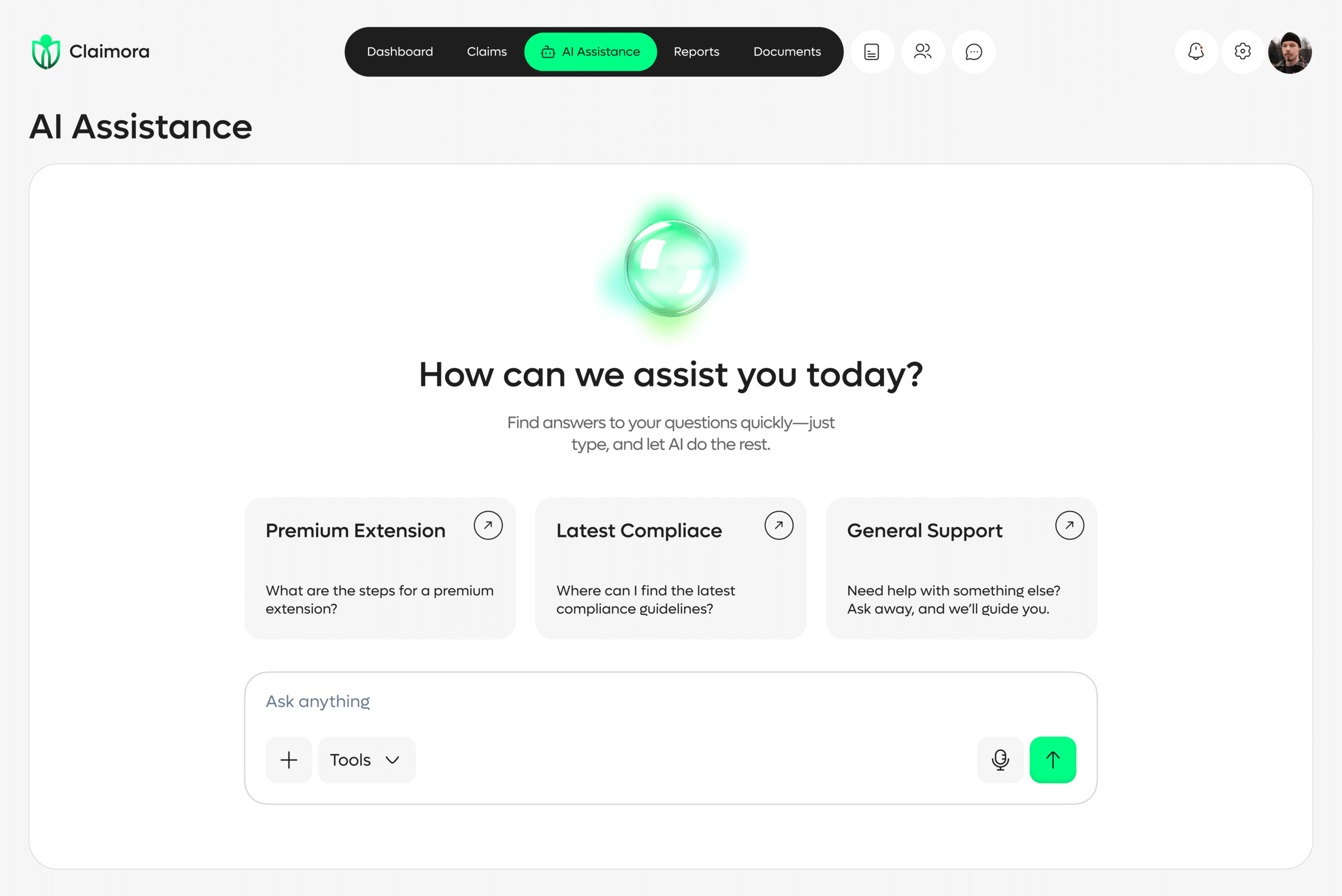

Our development team implemented modern Optical Character Recognition and Natural Language Processing to fetch, interpret, and validate data from claim forms and support documents. As a result, it eliminates manual dependency for entries, improve accuracy, and accelerate the verification process.

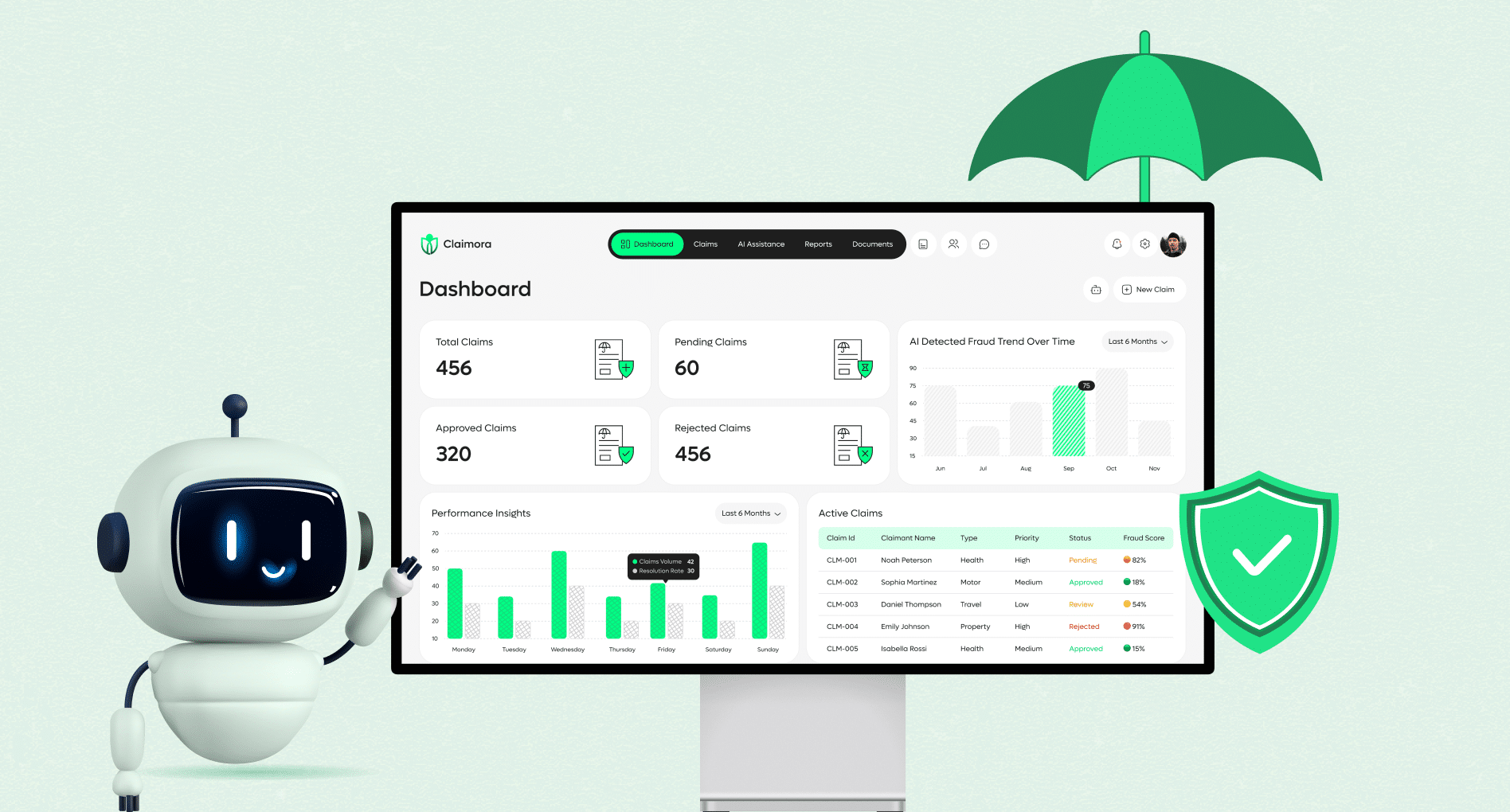

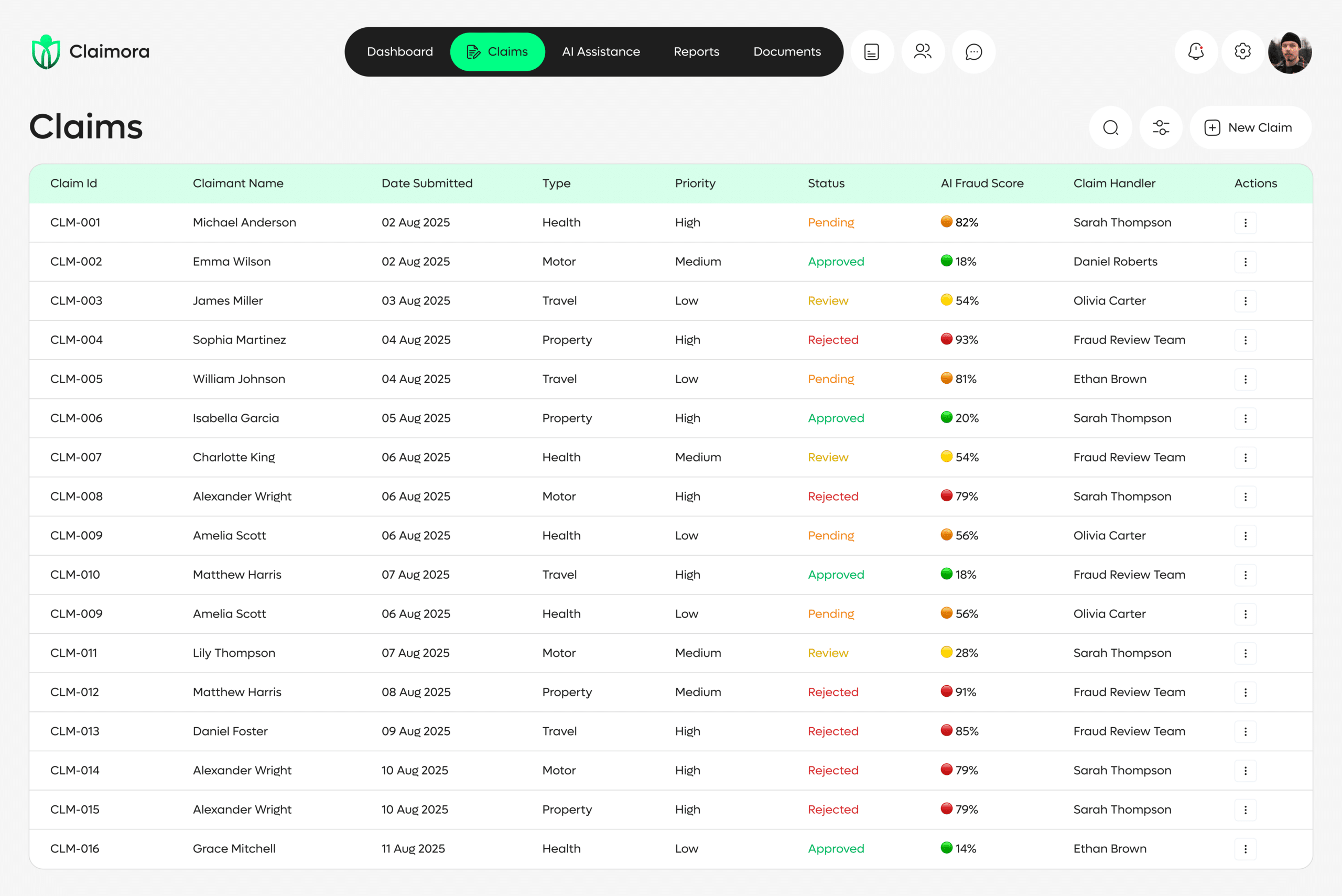

We engineered custom machine learning algorithms that is capable of figuring out irregular claim patterns and predicting fraudulent activities. By analyzing historical claim data, the system continuously learns and enhances its fraud detection accuracy, helping the client prevent losses and maintain operational integrity.

Our team designed and developed a dynamic dashboard that provides real-time visibility into claims, performance metrics, and process bottlenecks. The intuitive interface enables managers and decision-makers to track claim status, analyze trends, and make informed decisions swiftly.

To ensure smooth adoption, we enabled secure API integrations with the client’s existing CRM and ERP systems. This interoperability allowed for automated data flow between departments, reduced duplication, and improved collaboration across the organization.

We deployed the solution on a robust cloud infrastructure designed for high availability and scalability. Our architecture ensured complete data security, compliance with industry regulations, and flexibility to handle future growth in claim volumes without compromising performance.

Automated workflows accelerated claim handling from days to hours.

AI validation minimized human errors and inconsistencies.

ML algorithms identified fraudulent patterns early, saving substantial costs.

Real-time claim status and faster resolutions increased customer satisfaction.

Reduced manual workload allowed staff to focus on high-value decision-making.

Cloud-based deployment ensured seamless scalability for future growth.

SPEC House, Parth Complex, Near Swastik Cross Roads, Navarangpura, Ahmedabad 380009, INDIA.

This website uses cookies to ensure you get the best experience on our website. Read Spec India’s Privacy Policy