Fraud detection in financial services is increasing at a rapid rate. According to industry research, financial institutions are losing billions of dollars annually to fraud, and one of the largest platforms targeted by digital payments includes it. Fraud does not occur every now and then anymore, with instant payments being the norm, mobile banking being the norm, and online transactions being the norm; it occurs every second, sometimes in milliseconds. What is more difficult is that most fraudulent transactions appear as real transactions until it is too late.

Simultaneously, banks and other financial institutions are handling millions of transactions daily, dealing with data from various sources, and are subject to the heavy burden of regulatory pressure. The customers require quick approvals, zero delays, and safe experiences simultaneously. Older fraud systems, typically based on batch processing or predefined rules, are unable to match this pace and complexity. They either detect the fraud too late or block the real customers by accident.

This is one of the reasons why most financial organizations are gravitating towards Databricks. In Databricks, fraud detection and risk analytics occur in real time, on large and vast data volumes, and based on advanced machine learning. It unites the data on transactions, customer behaviour, and risk indicators on one platform. More to the point, it does so without compromising security, governance, or compliance- keeping institutions secure, compliant, and customer-friendly in a rapidly changing digital environment.

In this blog, we are going to discuss risk analytics in finance and how financial institutions deal with it.

The financial institutions deal with large amounts of transactional data, as well as customer data, and fraud detection and risk analysis become complicated. Databricks is a platform that offers a single platform to analyze this data in real-time, model machine learning, and reveal risk patterns more quickly. It allows organizations to detect fraud earlier, minimize false positives, and make more precise, data-driven risk-taking decisions at scale with the assistance of modern data engineering and high-quality analytics. The following are some tips that have been proven for how Databricks is applied in risk analytics in finance.

It is not the lack of data that financial institutions are troubled by; it is the problem of fragmentation and latency of data. Risk analytics and fraud detection rely on the correlation of transaction behavior, customer history, and real-time signals. Fraud teams must respond slowly to these data sources when they are stored in different systems, further exposing the company to financial losses and customer frustration. Databricks handles this fundamental issue by integrating data and permitting more intelligent and quicker fraud detection.

Read More: Real-World Databricks Use Cases Across Industries

Financial frauds occur in seconds, not hours, in the modern world. Most of the traditional systems that operate in batches usually detect fraud when it is too late. By deploying Databricks, financial institutions can replace delayed detection with real-time fraud detection so that, as transactions are processed, risky activities can be flagged without disrupting day-to-day legitimate customer activity.

AI fraud detection in banking has become critical as fraud systems based on rules are no longer sufficient. The patterns of fraud keep changing, and the reason is that the rules do not stand up to scrutiny. Databricks makes it possible for financial institutions to develop, train, and deploy sophisticated machine learning models to adjust to new fraud patterns and enhance risk accuracy over time.

Fraud detection, risk management, and compliance usually work on different tools and reports, and thus, the decisions are not consistent. Databricks unites these teams on a data and analytics platform that makes them align quickly and have more assured decision-making.

Financial institutions should be able to be innovative without interfering with compliance. Databricks is built to be compatible with advanced analytics and also has high governance, security, and regulatory controls, which is why this cloud can be used in highly regulated environments.

The volume of fraud is high during peak hours, seasonal occasions, and surges in digital payments. Databricks enables financial institutions to use analytics on scale without impacting performance or incurring costly re-architecture.

Databricks enables financial institutions to spot fraud sooner, evaluate risk more precisely, and respond to emerging threats more effectively by uniting data, enhanced analytics, and machine learning on one platform so they can operate with confidence. These outcomes can be attained, though, only with a good database. This is where data engineering services play a critical role.

It helps to make sure that data is quality, scalable, controlled, and prepared to be utilized in real-time analytics. Having the appropriate data engineering capabilities will enable the banks and financial institutions to realize the full benefit of Databricks to detect fraud more intelligently and perform risk analytics.

Financial institutions do not invest in fraud and risk platforms just to be able to continue using technology, but rather to achieve quantifiable business results. Databricks for financial services makes a lot of tasks easier as it has a direct impact on the rate of fraud detection, the effectiveness of risk evaluation, and the certainty in making decisions throughout the organization. Databricks provides financial institutions with an opportunity to transition from responsive loss management to predictive capability, machine learning, and data to risk management that safeguards revenue, reputation, and customer confidence.

Early detection of fraud assists financial institutions in preventing losses even before they occur. Risky behavior can be identified by verifying the transactions that are made and detecting any differences in transactions with previous activity. It is also a system that learns from past fraud cases, and this would prevent the occurrence of the same form of fraud in the future. This minimizes losses in cards, electronic payments, and internet transactions.

Numerous fraud prevention mechanisms are preventing honest customers unintentionally. Databricks mitigates this issue with the help of customer behavior analysis rather than preset rules. It knows the way a customer spends and behaves in a normal way. This assists in preventing unnecessary declines in transactions or blockage of accounts. Consequently, customers will be able to utilize the banking services easily, and they will still have a sense of trust in the institution.

Real-time fraud detection is possible with Databricks. Risk decisions must be fast and accurate. Databricks offers a real-time risk score on transactions and customers. This assists the teams in making immediate decisions on whether an activity is risky or safe. Due to the utilization of the same data in other systems, decisions remain the same in products and channels. There is also a clear ability for teams to know why a transaction was flagged.

Regulatory reporting automation becomes easier when data is traceable and clear, making it simpler to meet regulatory rules. When data is traceable and clear, it becomes easier to meet the regulatory rules. Databricks tracked the origin of data and its utilization. This will assist financial institutions in complying with AML, KYC, GDPR, and PCI DSS. In the event of an audit or investigation, the teams can exchange correct information in a short time, which saves time and stress.

The level of fraud risk tends to increase as the number of transactions increases. Databricks enables systems to cope sluggishly with more transactions. It is able to adapt rapidly to new fraud procedures and regulations. This simplifies the process of financial institutions introducing new digital banking and payment services while maintaining risk at check.

In addition to analytics and insights, Databricks assists financial institutions in transforming data into quantifiable business results, such as faster fraud detection, less operational risk, better compliance, and better decision-making at scale. To achieve this maximum effect, organizations have a tendency to integrate the Databricks platform with custom financial software development services that align technology with actual banking processes.

This will see analytics-based solutions effectively integrated within the current systems, which in turn helps the institutions to create long-term value, efficiency, and resiliency in their operation.

It is not that financial institutions select Databricks because they need to process data; they select it because they want to develop confidence in all fraud and risk determinations. Speed, scale, intelligence, and trust are all needed to work together in an environment where transactions occur in milliseconds, and patterns of fraud change at any given time.

The Databricks platform gives this ground by consolidating the data, facilitating real-time analytics, and driving adaptive machine learning models. It resolves your day-to-day operational challenges, which involve data fraud, and reduces the risk of losing data to a great extent. That’s why most financial institutions prefer data bricks over other technologies.

Do not think much, just connect with us for fraud detection software development and explore how we can help you build a secure, scalable, and future-ready platform.

Databricks is used by financial institutions due to the fact that it combines data engineering, analytics, and machine learning within a single platform. It assists teams in analyzing transaction data almost in real time, identifying suspicious activities early, and constantly training fraud models with AI and ML. This centralized solution is less time-consuming and enhances the accuracy of fraud detection.

Yes. Databricks is developed based on Apache Spark, which is developed to manage huge amounts of data effectively. It has a capacity of processing millions of transactions per second, so it is useful in fraud analytics where speed, scalability, and precision are vital, particularly during high transaction rates.

The conventional data warehouses are primarily intended for historical reporting and batch analytics. Databricks, in its turn, is compatible with real-time data processing, advanced analytics, and machine learning. This makes Databricks more applicable to fraud detection applications where institutions require better insights and dynamic fraud models.

Databricks is a pay-as-you-use service, meaning that institutions do not pay to use the entire amount of compute and storage units that they provision. It also removes the necessity to use several tools in the process of data processing, analytics, and ML being executed on the same platform- this will aid in minimizing the cost of infrastructure and operation.

Databricks will help institutions shift to predictive risk modeling as opposed to a reactive one. Its combination of historical data and real-time data can assist in detecting early indicators of fraud, anomalies, and patterns of risk, based on this, by enabling the team to intervene before the losses are incurred.

Absolutely. Databricks is very scalable and adaptable, and therefore is well-suited to the NBFCs and FinTechs where data and trends of fraud are rapidly increasing. It enables fast innovation, fast model development, and data processing that is ready to comply, without investing heavily in infrastructure development.

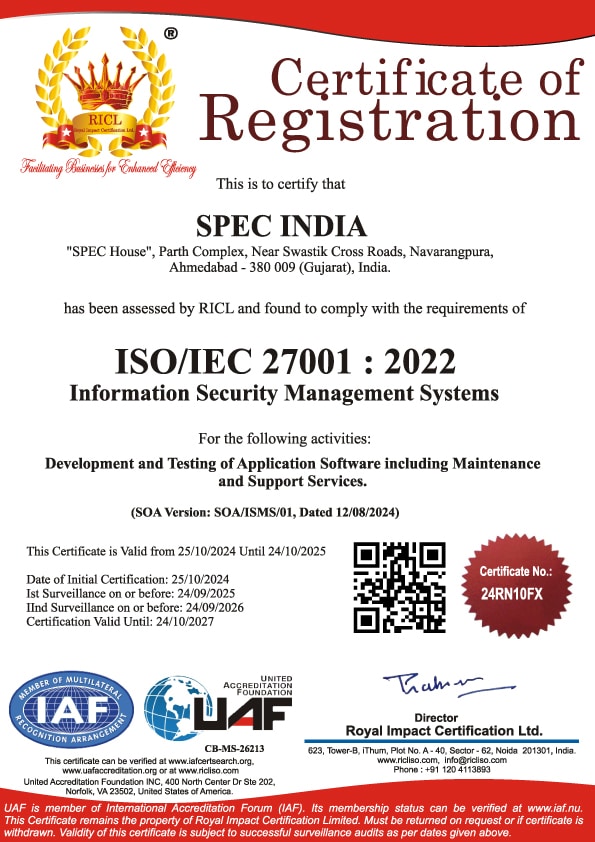

SPEC INDIA is your trusted partner for AI-driven software solutions, with proven expertise in digital transformation and innovative technology services. We deliver secure, reliable, and high-quality IT solutions to clients worldwide. As an ISO/IEC 27001:2022 certified company, we follow the highest standards for data security and quality. Our team applies proven project management methods, flexible engagement models, and modern infrastructure to deliver outstanding results. With skilled professionals and years of experience, we turn ideas into impactful solutions that drive business growth.

SPEC House, Parth Complex, Near Swastik Cross Roads, Navarangpura, Ahmedabad 380009, INDIA.

This website uses cookies to ensure you get the best experience on our website. Read Spec India’s Privacy Policy