May 16, 2025

September 4th, 2025

Think insurance is still all paperwork and long wait times? Think again.

The traditional insurance model is under heavy pressure with juggling between paper trails, delayed claim settlements, and one-size-fits-all policies. But nowadays, customers’ expectations are higher and are even met by your competitors. They demand personalization, agility, accuracy, and round-the-clock services across devices.

So, how are your competitors winning their hearts?

They have simply implemented digital transformation in insurance, making every step from policy evaluation to making the final decision automated, time-saving, and cost-effective.

According to BCG, customers prefer digital channels for collecting information and getting quotes through online platforms.

This blog explores how transforming your insurance business digitally can uplift your business, drive growth, and reduce customer churn rate. We have also discussed the potential of cutting-edge technologies to enhance the customer experience and increase the retention rate.

The core of insurance operations relies on complete digital integration, spanning policy administration, underwriting, claims handling, customer interactions, and fraud prevention. However, it’s much more than simply using modern tools; digital transformation represents an organizational and cultural evolution that reshapes the insurance value chain, adapting to modern customer expectations and market strategies in the digital economy.

The shift toward mobile app development for insurance has enabled insurers to provide accessible, user-friendly contact points that meet market demand for real-time service assistance. Predictive analytics in insurance has enabled organizations to more effectively evaluate risks and combat fraud, while developing customized solutions that yield more precise results with higher operational efficiency.

Insurers must undergo a critical organizational change that addresses current business needs at an unprecedented level. The digital transition in customer expectations, including immediate access, tailored service, and easy digital operations, forces insurers who resist change to lose their market position. Success relies on more than technology because it necessitates embracing the current situation.

Let’s break down what this transformation typically includes:

To truly understand the value of digital transformation in insurance, it is essential to know how it is revolutionizing other industries:

The speed of technological progress surpasses historical records of customer demand escalation rates. Delaying digital transformation in insurance means:

In contrast, Insurers who integrate digital transformation create immediate market advantages and maintain lasting success by delivering personalized data-driven services. Today, enterprise insurance companies utilize insurance software development to streamline their day-to-day insurance tasks with ease.

Before recent developments, insurance processes were slow and cumbersome, relying on paper documentation and intricate operational procedures; however, this is quickly changing. Industry improvements in digital transformation now speed up operations and deliver more innovative platforms with enhanced user-friendliness. AI works like an intelligent virtual assistant that learns to understand your needs better each day. Here are some of the biggest trends that are reshaping how insurance works today:

Your insurance provider would begin anticipating your needs without your requests. Machine learning technology, combined with AI, enables insurers to anticipate their customers’ needs.

Your health insurer offers you discounts when your smartwatch detects that you maintain an active lifestyle.

You know those smart devices—like fitness trackers or car sensors? These new technologies now serve a dual purpose, benefiting not only you but also others. Insurance companies are using the data they collect to:

When your smartwatch demonstrates high physical activity, your health insurance provider might offer reduced rates as a reward. It’s a win-win.

Customers now avoid wasting 30 minutes on hold for policy inquiries because of automated support. Chatbots are changing the game by:

These systems remain available at all times and continue to learn new functions on a daily basis.

You may have heard about blockchain in the world of cryptocurrencies, but it’s also making significant contributions in the insurance industry. It helps:

Blockchain technology creates digital records that operate as tamper-proof, secure systems.

Through cloud technology, insurance businesses acquire efficient operations and flexible capabilities. With cloud systems, they can:

Their improved insurance system enables faster service delivery tailored to your needs.

Have you ever booked a flight and had travel insurance included automatically? That’s embedded insurance. The phenomenon grows steadily while providing users with effortless insurance acquisition at pertinent moments of need.

Separate policy searches become unnecessary because this feature suits those who avoid traditional hunting methods. This shift is a clear result of digitalization in the insurance industry, made possible with software development that integrates coverage directly into everyday purchases.

Everyone wants to feel like a company “gets them,” right? Insurers are now using data to create:

So whether you’re a first-time car owner or a small business owner, you get recommendations that actually fit your needs. These experiences are powered by advanced insurance software development and reflect the ongoing digitalization in the insurance industry.

Every stakeholder within the insurance sector experiences numerous positive changes when the industry adopts digital approaches. Key benefits include:

1. Creating Seamless and Personalized Customer Experiences

The digital landscape provides customers with enhanced capabilities for purchasing insurance, managing their policies, and filing claims. Digital tools reduce customer wait times and customize each process to improve their overall experience. This is a key component of digital transformation for insurance, where operational efficiency meets intelligent automation.

2. Streamlining Operations with Automation and Smart Workflows

Automation enables the completion of previously time-consuming processes, such as underwriting and claims processing, within a few minutes. The use of predictive analytics in insurance enables providers to forecast trends, optimize pricing, and deliver proactive solutions that better meet customer needs.

3. Making Smarter Decisions Through Real-Time Data and Predictive Analytics

The availability of substantial customer and behavioral data enables insurers to more accurately assess risk, establish rational premium rates, and implement loss prevention measures proactively.

4. Driving Product Innovation to Meet Changing Customer Demands

Through digital transformation, insurers can create insurance products tailored to usage or demand that better suit contemporary digital customers.

5. Reducing Costs by Eliminating Manual Work and Legacy Systems

The transition to digital solutions and cloud-based systems delivers significant operational and financial benefits through paperless processes, workforce reductions, infrastructure simplification, and productivity growth.

6. Adapting Quickly to Market Changes with Scalable Digital Infrastructure

APIs, along with cloud solutions, enable insurance providers to adapt their service capacities to meet market needs. It also helps them accelerate feature development to maintain their position in an evolving industry.

Digital transformation plays a crucial role in helping businesses survive in the digital-first era. Take a look at some of the industry’s best examples of digital transformation and how they are helping to ease day-to-day operations.

Digital transformation yields numerous advantages, but organizations sometimes struggle with the implementation process. Insurers—mainly traditional ones—often face a few bumps along the road:

Insurance companies often maintain outdated technological infrastructures, which hinder easy modernization and integration with current technical advancements. The upgrade or replacement of these systems entails significant expenses and long-term deployment durations. The critical nature of insurance legacy system transformation allows insurers to create modern core platforms that enhance agility and maintain alignment with evolving digital requirements.

Insurers need to process substantial quantities of personal customer data within their digital operational framework. The protection of data information, as well as compliance with GDPR and HIPAA standards, creates significant challenges for organizations that require secure protection against data breaches.

Digital transformation goes beyond technological frameworks. It’s also about mindset. Digital employees, together with senior executives, commonly resist workflow changes because they fear job elimination or demonstrate limited technical aptitude with new technological deployments.

When different digital tools and services are integrated, they can face challenges in connecting due to a lack of design cohesion between systems.

Many insurers face substantial challenges when investing in new platforms, employee training, and data migration, only to realize digital savings in the future.

Explore More: Crucial Challenges of Digital Transformation and How to Overcome Them

SPEC INDIA delivers technology solutions that lead organizations toward transformational outcomes with components that surpass basic technological structure. Our team creates interactive digital platforms, including simple mobile apps and self-service insurance sites, which enable your customers to connect more effectively with your solutions.

Here’s how we can support your digital transformation journey:

Our approach replaces outdated system platforms with contemporary technology to build high-performing, secure systems that ensure the future readiness of your infrastructure. Our method of legacy application modernization offers improved transition processes, enhanced integration possibilities, and extended operational scalability for insurance operations.

The team develops straightforward insurance portals and mobile apps, making your service engagement accessible to customers. Our insurance mobile application development work yields smooth, user-friendly software that fosters long-term customer satisfaction.

We help you develop your digital roadmap, then identify its alignment with business goals before validating how all your investments drive measurable financial returns. AI and Predictive analytics in insurtech help in identifying new profit opportunities while enabling personalized interactions with customers.

SPEC INDIA functions as a digital transformation collaborator, providing organizations with expert guidance to achieve business-focused transformations that meet client requirements.

We don’t just implement—we advise. With expert guidance, your organization can create an optimized digital strategy while the team maintains goal alignment and verifies all investment decisions’ return on investment.

Insurance operations need digital transformation as a fundamental requirement. Insurance companies need to transform their operations because rising customer expectations alongside advancing technology put them at risk of being displaced by competitors. Digital transformation enables businesses to create better customer experiences and develop stronger enterprises through automation, real-time data analytics, and AI-powered simplified claims processing.

Despite potential hurdles, your organization will experience increased efficiency, more satisfied customers, and improved long-term growth potential, making this investment opportunity worthwhile. With the right insurance software development approach, these goals become more achievable than ever.

Together, we will guide you through your digital transformation journey, starting with strategic planning and progressing to implementation.

Contact our experts to start developing smarter, customer-centered insurance solutions.

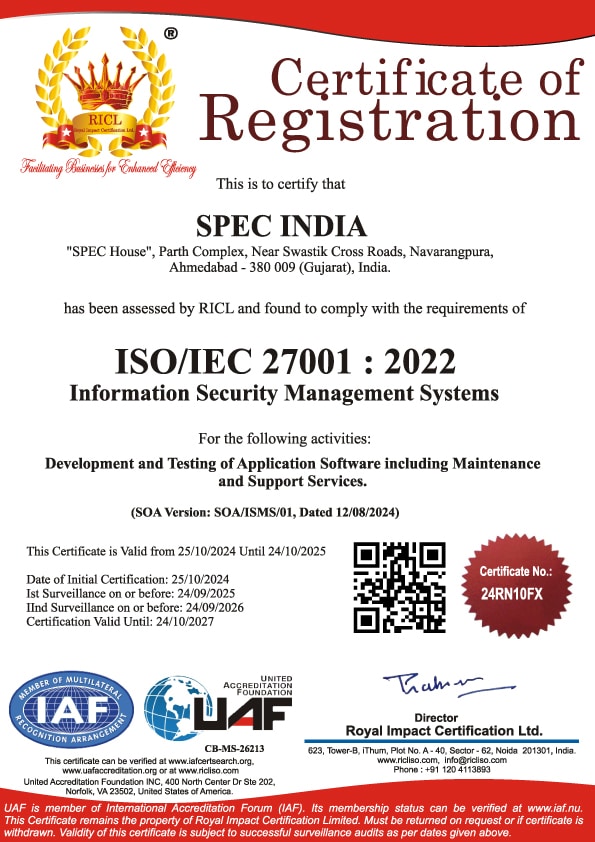

SPEC INDIA is your trusted partner for AI-driven software solutions, with proven expertise in digital transformation and innovative technology services. We deliver secure, reliable, and high-quality IT solutions to clients worldwide. As an ISO/IEC 27001:2022 certified company, we follow the highest standards for data security and quality. Our team applies proven project management methods, flexible engagement models, and modern infrastructure to deliver outstanding results. With skilled professionals and years of experience, we turn ideas into impactful solutions that drive business growth.

SPEC House, Parth Complex, Near Swastik Cross Roads, Navarangpura, Ahmedabad 380009, INDIA.

This website uses cookies to ensure you get the best experience on our website. Read Spec India’s Privacy Policy