January 29, 2025

August 8th, 2025

It is forecast that the global insurance market will grow by about one trillion U.S. dollars between 2024 and 2029, reaching almost $10 trillion. – (Source: Statista)

Aren’t these numbers amazing?

This growth brings along with it customer expectations as well. Customers now need to be able to access their insurance services through an application or software on their phones. They expect the process of checking policies, filing claims, and making payments to take a few taps using their mobile phones.

Insurance companies know that custom insurance mobile app development isn’t a luxury but rather a necessity in this day and age. Such applications assist insurers in establishing communications with their clients, increasing the rate of performance, and delivering specific services. They also facilitate the process of understanding customers’ needs and risks and enable one to come up with better solutions. Building custom mobile apps tailored for the insurance sector is essential, with a focus on scalability and integration of advanced features to meet evolving demands.

In this guide, we’ll walk you through the basics of building an insurance mobile app. As part of the global insurance ecosystem, it is crucial to develop apps that integrate seamlessly within this broader landscape to support industry-wide connectivity and innovation. We’ll provide simple and practical advice on everything from starting to creating an app, from defining the key features to the possible obstacles that might come your way. Let’s start by understanding the overview of the insurance mobile app and its key features.

The insurance industry is experiencing a digital revolution, and insurance mobile apps are at the heart of this transformation. These apps have changed the way insurance companies connect with their customers, making it easier than ever to access insurance services anytime, anywhere. With just a few taps, users can review their policy details, file claims, and make secure payments—all from their mobile devices.

As the global insurance market continues to expand, reaching an estimated $8.4 trillion by 2026, insurance companies are recognizing the need to invest in insurance app development to remain competitive. Insurance apps not only streamline internal processes for insurers but also deliver a seamless, user-friendly experience for policyholders. Whether it’s checking coverage, managing policies, or submitting claims, insurance mobile apps empower customers and help insurance companies build stronger relationships in an increasingly digital world.

By embracing insurance app development, insurers can meet rising customer expectations, improve operational efficiency, and position themselves as leaders in the global insurance market.

Integrating mobile applications in the insurance industry is reshaping how insurance companies operate and engage with customers. Insurance application development is at the core of this transformation. The growing adoption of mobile insurance apps is driving innovation and efficiency across the industry. It helps companies to provide their customers with better services.

Here are ten insightful statistics highlighting this transformation:

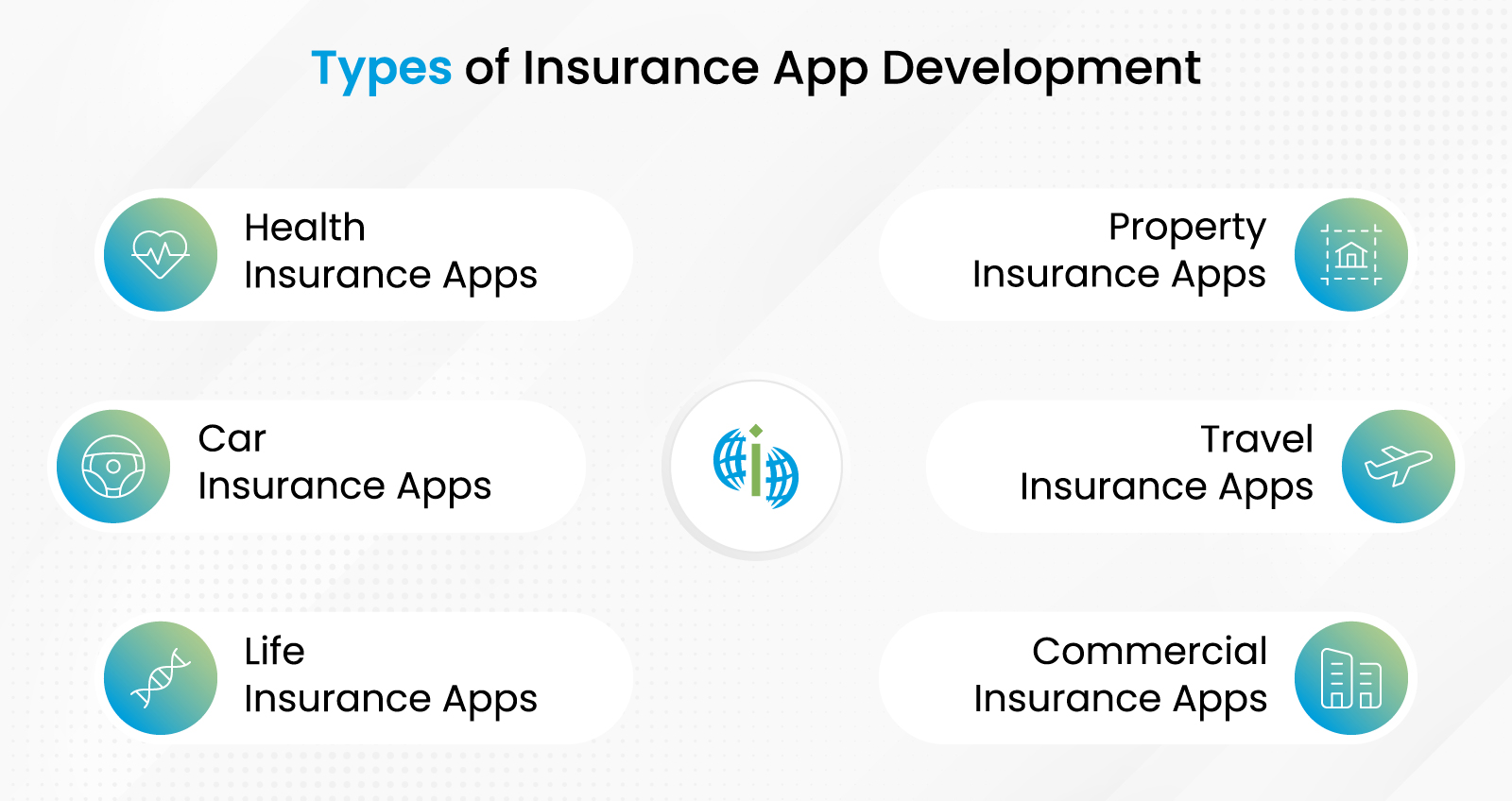

People should know that not every app is the same. They are all unique and created with different functions to meet certain requirements. Let me explain the different types of insurance mobile application development and what these apps are used for. Key categories include auto insurance and business insurance, which are essential for vehicle owners and companies seeking to manage coverage, reduce risks, and streamline claims through digital solutions.

Think of these as your all-in-one health assistant. For those basic requirements such as confirming your coverage, submitting a claim after seeing a healthcare provider, or scheduling an appointment? It’s all possible here. Some even link directly to fitness bands that can help you maintain fitness levels and get rewarded!

You can check our Live BI visualization for better and in-depth idea about how healthcare insurance analysis dashboard is operated and offers information.

It can be fun and useful to have an application that allows not only filing claims after an accident but also rewards safe driving behavior with lower premiums. For instance, if you are in the middle of the road and need help, you can get roadside assistance without having to wait. Handy, right?

These particular apps are your best friends for keeping those long-term plans in check. A life insurance app offers convenient features like policy management, claim processing, and premium calculations, all within a user-friendly interface. Regardless of whether you want to check on the status of your policy, make premium payments, or prepare for your financial future, it is possible to do so by using life insurance apps.

A Property insurance app, or a home insurance app, plays a major role in protecting your biggest asset, your home. These applications ensure that details of the property are uploaded and, more crucially, take care of all the claims in case of damages or disasters. Property insurance apps also provide users with easy access to their insurance coverage information, allowing them to quickly review what is protected and manage their policies efficiently.

Suppose you are on a trip, something goes wrong, or you need urgent medical attention. With a travel insurance app, you can access help, check coverage, and submit a claim—all with just a few taps.

For business owners, commercial insurance apps are a blessing. It allows you to administer policies that secure your tangible and intangible company assets, your workforce, or business processes while focusing on business and the company’s day-to-day operations without the burden of paperwork.

Typically, insurance mobile apps allow citizens to transact their insurance at their convenience, time, and place. These apps allow consumers to access their policies, pay premiums, report losses, and seek assistance as quickly as possible. Insurance companies assist in enhancing services, reaching customers, and making the right decisions with data.

They make insurance easy, quick, and accessible all through an app that consolidates all the processes for all the users. For an insurance app development company, it has to offer what will help manage the insurance conveniently. Here are some key features every app should include: Incorporating a wide range of insurance app features is essential for delivering a superior user experience and staying competitive in the rapidly evolving insurance industry.

A robust admin panel serves as a centralized, secure dashboard within the insurance app, allowing administrators to manage user profiles, oversee payments, configure push notifications, and control key operational features. This control interface streamlines insurance-related tasks and provides essential business oversight.

Explore Case Study: Transforming Health Insurance with Data-driven Analytics

Insurance mobile app development is important as it is beneficial to both the customers and the insurance companies in their respective endeavours. In today’s world, where digital transformation in insurance is reshaping the industry, customers seek ease and convenience, and mobile apps address these needs effectively. From easier administration of policies to easy access to claims and payments, these applications offer a boost to customer satisfaction. Additionally, insurance mobile apps help streamline the insurance process for both customers and providers, making workflows more efficient and user-friendly.

For insurance providers, insurance app development can be useful decision as it lead to improved efficiency, lower expenditure and enhanced customer relations. Let’s dive into the key benefits of developing life insurance apps for your business.

Continuous updates and user feedback play a crucial role in enhancing insurance offerings, ensuring that mobile apps deliver improved products and services over time.

Don’t just keep up with the industry—lead it. With AI, you can personalize every policy, automate every claim, and stay connected with your customers 24/7. Let’s make insurance intelligent.

User engagement is a cornerstone of successful insurance app development. Today’s insurance apps are designed to do more than just provide basic policy information—they aim to keep users actively involved and satisfied with their insurance experience.

For example, health insurance apps often include wellness features like fitness tracking, personalized health tips, and reminders for regular check-ups, encouraging users to take charge of their health. Car insurance apps can offer instant roadside assistance, easy accident reporting, and real-time claims tracking, making stressful situations more manageable. Life insurance apps provide policyholders with quick access to policy details, premium payment options, and beneficiary management, ensuring peace of mind for the future.

By integrating these engaging features, insurance companies can boost user engagement, foster customer satisfaction, and encourage regular app usage. The result? Higher app adoption rates, improved loyalty, and a stronger competitive edge in the insurance industry. Ultimately, a well-designed insurance app not only meets customer needs but also drives business growth for insurers.

Developing an insurance mobile app could seem like a huge project, but when the project is segmented, then it’s easier. The thing is to concentrate on the objectives and move accordingly; it may seem simplistic, but it is actually effective. Let’s go through the process in a way that’s easy to understand:

Understand What You Want to Achieve

First of all, one must try” to answer the following question”, ‘What this app has to perform at’. I wonder if it is about enhancing the customers’ ability to deal with their policies. Or are you concerned with optimization of claims and payments? Developing goals will serve the purpose of defining the purpose of your app.

If you truly want to differentiate yourself, then focus on features that help customers solve their most frequent issues.

Dive into Research

There are two types of research that must be done prior to working on a project. We also need to consider what your competitors are doing and what you expect from your audience. This will assist you in choosing what new features and services your app should offer. Explore insurance app development solutions that are tailored to different market needs, ensuring your app is scalable and meets specific customer demands.

Think about your ideal user—what would make their experience smooth and stress-free?

Decide on Key Features

When selecting the features to offer in your insurance app, avoid complexity, but instead, prioritize areas such as easy sign-up, clear policy details, smooth claims submission, secure payment processing, and good customer service. Consider integrating features that connect users directly to an insurance agent or enable communication with insurance agents for personalized support and quote requests. Customers are satisfied and actively use a clear and easy-to-navigate app. As we discussed above, the features of an Insurance mobile app clearly depict the value of adding them and what can happen if you skip them.

Simplicity is key. The simpler it is – the more your customers will like it.

Choose the Right Tech

Will your app be for iOS, Android, or both? Or would a cross-platform app make more sense? Such decisions have implications for how much time and money you will require.

Native applications are stand-alone apps developed for a specific platform and are ideal when you do not want to redesign the app for another platform. You should also consider insurance web app development as an option for delivering digital insurance solutions, such as claim submission and client service facilitation.

Design an App That’s Easy to Use

Your insurance app design should be aimed at not outcompeting other apps, but rather to be intuitive and natural for a user to interact with. The interface should be free from complexity, easy to understand, and have good graphics. Imagine using that interface with basic experience and no knowledge about technology.

It’s important that you should always make your designs accessible to a small group of users to find where your design needs improvement.

Build the App

Work with experienced developers who can bring your vision to life. Focus on both the front end (what users see) and the back end (how everything works behind the scenes). Remember to always take security into consideration even while working on insurance data. Quality assurance engineers play a crucial role in testing and validating the app to ensure its security, stability, and overall performance.

Test It Thoroughly

Before launching, test the app on different devices and scenarios. Look for bugs and frequent crashes and ask yourself how easy or difficult the software was to use. It is also essential to protect user data and adhere to compliance requirements such as GDPR, PCI-DSS, and HIPAA to safeguard sensitive information.

This step is crucial. A minor glitch can anger the users and lead to critical consequences for your company.

Launch Your App

Finally, once everything is set and caught with keen attention, it is time to go live. Make your app available on stores such as Google Play and the App Store. Pair this with a marketing campaign to let your audience know it’s available.

Listen to Feedback

After the launch, simply ask the users of the insurance app design interface for their opinion. User feedback is a key driver for continuous improvement, helping you address concerns and enhance the platform. They are also important in letting you know how to improve your work.

Encourage reviews. It is beneficial to your business and establishes credibility for fresh users.

Keep It Updated

Customers and technology know a lot of constant evolution. Updates are relevant, efficient and provide security to your app hence they should be done on regular basis whenever the need arises.

Cost

When planning your project, keep in mind that insurance app development cost can vary significantly based on factors such as app features, complexity, and the location of your development team. Understanding these factors will help you manage your budget and set realistic expectations.

Check Out Our Detailed App Development Process to Better Understand How We Works at SPEC INDIA.

Choosing the right tech stack is a critical step in insurance app development, as it directly impacts the app’s performance, security, and user experience. Insurance app development companies typically select technologies based on the app’s complexity, target audience, and required features.

For native app development, languages like Java and Kotlin are popular for Android, while Swift is the go-to for iOS. If you’re aiming for cross-platform compatibility, frameworks such as React Native and Flutter allow you to build insurance apps that work seamlessly on both platforms, saving time and resources. On the backend, robust databases like MySQL and MongoDB are used to securely store and manage insurance data, while cloud services ensure scalability and reliability.

The tech stack may also vary depending on the type of insurance app. For instance, a car insurance app might require advanced backend systems to handle claims processing and integrate payment gateways, while a health insurance app could prioritize a user-friendly interface for easy access to coverage details and health resources.

Selecting the right tech stack ensures your insurance app is secure, scalable, and delivers a smooth experience for users—key factors for success in the competitive insurance industry.

The estimates of how much it will cost to build an insurance mobile app depends on the following considerations. The insurance app development cost is influenced by factors such as the features you choose, the complexity of the app, and the location of your development team. The cost of a basic app might go somewhere between $15,000 to $30,000 and the cost might range further up to $50,000 to $200,000 for a full-fledged advanced app that might include features like — Artificial Intelligence claims processing as well as third-party integrations.

It also depends on whether you are planning to build the application for iOS or Android, or for both, and where exactly the development team is located (using offshore can be cheaper). One should also consider constantly updating the app to avoid getting neglected and having part of the app or even the whole app not function well. This is especially important in insurance app development, where regular updates ensure that the app remains functional and secure for users.

Creating an insurance app is by no means an easy task. There are several challenges along the way, but do not worry. We will be with you every step of the way. Let’s look at some common challenges and how SPEC INDIA tackles them:

Customers’ information is sensitive data that cannot be compromised due to security is of the essence when it’s involved. Also, there are some standards that you have to obey, such as GDPR, HIPAA, and PCI DSS.

How We Solve It: We ensure that every aspect of the app is tightly secured with encryption and secure APIs. We also perform periodic checks on everything to make sure they are compliant with all the rules.

Most insurance companies are still working under older systems, and getting these systems integrated with the modern app can pose a challenge.

How We Solve It: Like a bridge between the previous systems and the new app, we create solutions that help you transition. That simplifies the process and allows all systems to go smoothly without changing your current layout.

The insurance app must be easy to use for all users, and at the same time, must be effective in its functions. And that is not always possible to do.

How We Solve It: We state our priorities on simplicity and usability of the designs. Furthermore, we integrate accessibility options so no matter how tech-savvy a user of your app is, he or she will still be able to use it.

Insurance policies become so complex when you are dealing with health, car, life, property, or travel insurance in one application.

How We Solve It: All the management is sorted out with proper interface and dashboards where policy management is not at all a headache.

What happens when tens, hundreds, or thousands of people converge to use your app at the same time? It needs to be processed without a hitch.

How We Solve It: We incorporate cloud-based tools and ensure your app is designed to accommodate the traffic, especially during rush hours like claim submission.

Selecting the right insurance app development company is a crucial decision that can determine the success of your insurance app. The ideal partner should have deep expertise in the insurance sector, a proven track record of delivering high-quality mobile apps, and a team of skilled developers who understand the unique challenges of insurance app development.

A reputable insurance app development company will guide you through every stage of the insurance app development process—from initial discovery and planning to design, development, and deployment. They’ll help you define your app’s target users, choose the best tech stack, and ensure your app meets all regulatory and security requirements. Protecting sensitive user data and maintaining compliance with industry standards is essential in the insurance sector.

By partnering with an experienced insurance app development company, insurance businesses can confidently build custom mobile apps that enhance customer engagement, streamline operations, and support long-term business growth.

Insurance app development services cover the entire journey from idea to launch and beyond. These comprehensive services start with market research and competitor analysis to identify opportunities and define your app’s unique value. Next, user experience (UX) and user interface (UI) design ensure your insurance app is intuitive, attractive, and easy to navigate.

Development services include both front-end and back-end development, integrating essential features like policy management, claims processing, and secure payment gateways. Rigorous testing and quality assurance are performed to guarantee your app is reliable, secure, and bug-free before it reaches your customers.

Many insurance app development companies also offer ongoing maintenance and support, ensuring your app stays up-to-date with the latest technology and continues to meet user needs. By leveraging these insurance software development services, insurance companies can create tailored mobile apps that drive customer engagement, improve operational efficiency, and support their business goals in a rapidly evolving digital landscape.

Artificial intelligence plays a key role in transforming how industries operate and cater to customers. Talking specifically about the Insurance sector, then AI has a lot to offer and the sector has a lot to receive and revamp. Below are the comprehensive use cases that you can invest in to attract more customers, upgrade your business operations, and remove all the manual bottlenecks.

You can utilize AI to understand customer’s demographics, location, risk profile, and behavior. It helps you to tailor your insurance products offerings and pricings. With such data handy, you can:

Another great benefit of the integration of AI in insurance is you can uplift customer experience. All they seek is faster claims at the time of damage or loss. Providing them with everything seamlessly without any hassle is one of the easiest ways to hook them for life. Here’s how you can do it:

Result: reduces claim processing time from weeks to hours.

Insurance is a sensitive sector, and there are chances of data theft or fraud. To detect and prevent proactively, you can integrate AI in your systems. As soon as it identifies unusual patterns, it flags and notifies users about the activity, preventing data or monetary theft.

Result: with AI in insurance business, there are chances of 40% more fraud detection than traditional methods.

How about providing instant answers to your customer queries? Well, it has proven to increase customer satisfaction rate by 25% at least for the company like Allianz. Therefore, your investment won’t go in vain if you implement AI-backed virtual assistance to extend your helping hand to your customers.

It handles everything related to your business objective like:

Real-life example: Lemonade, an insurance company, uses an AI-backend chatbot to handle policy signups and another chatbot for claim settlement. They have noticed 90% of claims were settled instantly.

Underwriting takes time but with AI, you can cut down the unnecessary time spent in evaluating credit scores, medical history, lifestyle indicators, and social signals. It enables real-time underwriting decisions and eliminates human errors.

Insurance mobile apps are quickly gaining popularity as they serve insurance customers and providers in an efficient way. Such are the apps that will automate the flow of business, enhance customer relations, and control expenses. Even though designing an insurance mobile app has limitations like data security and compliance, the benefits overshadow the difficulties.

By staying ahead of insurance technology trends, insurers can continue to meet the ever-evolving needs of their customers, ensuring a more efficient and secure insurance experience for all. Whether you’re a customer looking for convenience or an insurer aiming to innovate, insurance mobile app development is the key to the future of insurance.

Artificial intelligence enables several features that ease customers’ lives. For example, it offers instant quotes and dynamic policy pricing for informed decision-making. Besides, AI helps with chatbots and voice assistant support to ensure timely responses to customers. Lastly, it even recommends policies after evaluating customer background, preference, and budget.

Yes, AI with its machine learning capabilities can detect anomalies, suspicious patterns, and inconsistencies across claims and documents. The insurance sector has already seen a drastic decrease in fraud and data theft.

AI learns and adapts, which is why it happens to meet compliance requirements like GDPR, HIPAA, and ISO/IEC 27001. It enables data encryption, anonymization, and ethical AI frameworks to prevent data leaks and security breaches.

Absolutely. AI evaluates user behavior, risk profiles, and preferences to recommend policies, plans, coverages, types, upgrades, or even help adjusting premiums dynamically.

Since AI operates round-the-clock, customer seeking information at any hour can connect with your insurance business at any hour of the day. This feeling of reaching out and getting prompts responses matters to the customers the most, which is one of the core success recipes of many brands across the globe.

You can connect with a software development company that has decades of experience in catering to different industries, expertise in traditional and cutting-edge technologies, and excellence in delivering flawless software.

SPEC INDIA is your trusted partner for AI-driven software solutions, with proven expertise in digital transformation and innovative technology services. We deliver secure, reliable, and high-quality IT solutions to clients worldwide. As an ISO/IEC 27001:2022 certified company, we follow the highest standards for data security and quality. Our team applies proven project management methods, flexible engagement models, and modern infrastructure to deliver outstanding results. With skilled professionals and years of experience, we turn ideas into impactful solutions that drive business growth.

SPEC House, Parth Complex, Near Swastik Cross Roads, Navarangpura, Ahmedabad 380009, INDIA.

This website uses cookies to ensure you get the best experience on our website. Read Spec India’s Privacy Policy